Yes Infinite Banking is available to Canadians!

Most people think that life insurance is just good for the death benefit, and although this may be true with term life insurance with other policies you can access the money inside your policy while you're alive. Whether it's personal, for your business or children, when done properly this strategy can be powerful.

Infinite Banking a Quick Guide:

Infinite Banking is a financial strategy that uses a specially designed dividend paying whole life insurance policies, to create your own personal banking system. With this policy, you can build up a cash value over time that you can access while you're alive. You can use this money to build wealth, invest, or whatever else you want. Simultaneously, the policy will provide a death benefit for your loved ones when you pass away.

However, there are several things to consider with this strategy

Cost: Whole life insurance is generally more expensive than other types of life insurance, ex: term insurance. We think it's best utilized within the Infinite Banking Strategy.

Returns: If you are solely relying on the growth in your policy, the returns of whole life insurance are usually lower when compared to other investments. With infinite banking your money can work more efficiently by having the same dollars working for you multiple times. (Confused? This might be better over a quick call)

Loans: A big part of Infinite Banking is borrowing against the cash value of your policy. But these loans aren't free. They come with interest, and if you're not careful, it could produce a negative result.

Complexity: Infinite Banking can be hard to understand and manage without the right knowledge. You need to plan carefully, or you could end up losing money.

Liquidity: If not designed properly it takes time to build up the cash values in a whole life policy. If you need money quickly, the design of the policy is even more important.

Taxes: The growth of the cash value in your policy is tax sheltered, but there could be taxes if you don't handle the policy correctly. For example, if you withdraw the cash or cancel the policy, you might have to pay taxes on the growth

Insurance Impact: If you use the policy mainly for financial reasons and take out large loans, it could reduce the death benefits your loved ones get when you pass away.

It's important to work with the right team who specializes in the Infinite Banking strategy to make sure it's the right fit for you and your financial goals.

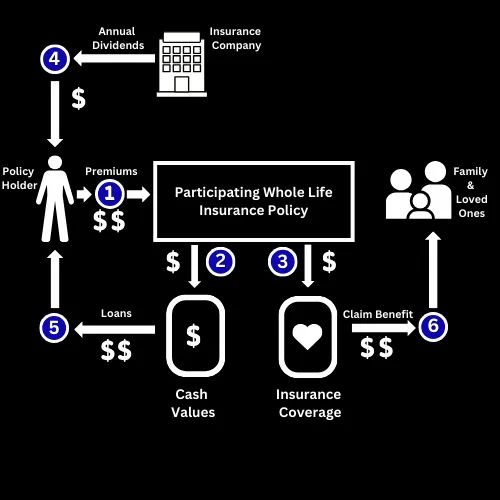

Infinite Banking In Action a Quick Visual:

A Quick Visual of

Policy Holder pay premiums (these can be monthly or annually which ever is most convenient for you)

Some of the monthly premium goes towards building your Cash Values (the money you can access while your alive)

Some of the monthly premium pays for the insurance coverage (aka the death benefit)

Every year you participate in an non guaranteed annual dividend distribution from the insurance company (which make the cash values and death benefit grow, when designed to do so). You participate in these distributions every year for the rest of your life.

You can access the cash values while you're alive by withdrawing or surrendering (full or partial) but it is recommended that you borrow against the cash values either by policy loan with the insurance company or collateral loan with third party bank. Once you have access the money, you can use it for what ever you chose, but it is recommended that you use it for investment purposes

When you pass away your family and loved ones (beneficiaries) would submit a claim to receive a tax free death benefit.

Working with Companies You Know & Trust

TESTIMONIALS

What our clients say:

"Found about this through Tiktok but as most I was intrigued and had questions. In my zoom meeting I had every question answered. Very informative, personable and knowledgeable team that's there to help you understand if this is a good fit for you and your portfolio.

So happy with this meeting. Time well spent. Looking forward to the follow up." - Michael M

"Very knowledgeable on financial literacy . Patient to answer to all queries. Good advice on options available for insurance policies.

Great talk Tadashi! Keep up the good job of educating the public on how to benefit from day to day finance needs." -

Joseph O

"I am extremely happy to have come across Tad and his team, they are very professional and knowledgeable, this has been a life changing experience and I am sure we will have a long and prosperous relationship.

Thank you Tad and your team.

God bless you all." - Gerardo G.

"I leaned more in one hour than anyone has taught me in my whole lifetime. Tadashi explained everything so clearly and was very patient with all of my questions." - Lisa F

"Tadashi was professional and answered all my questions" -Bryan S

"I learned a lot today as what my investments can do for me. It was a very pleasant experience"-

Linda R

TikTok

Instagram

Facebook

LinkedIn